35+ how long work history for mortgage

Get Your Pre-Approval. Ad Ownerly Helps You Find Data On Homeowner Property Taxes Deeds Estimated Value More.

Fha Loan Calculator Check Your Fha Mortgage Payment

Then about 10 days before your scheduled closing its not uncommon to re-verify your employment.

. Lowest Rates Easy Online Process. Compare offers from our partners side by side and find the perfect lender for you. Employment rules by loan type are as follows.

Repeat this process if additional Employment History entries are needed. Click the Save button. With FHA loans and conventional loans.

Ad Easier Qualification And Low Rates With Government Backed Security. At the end of the 5 years they would face a balloon payment with the entire principal of the loan. Comparisons Trusted by 55000000.

If youve been in your role for two years then your mortgage process wont be impacted. But there are also certain scenarios where an exception can be made. You will also have to explain any changes in your employment andor income that occurred.

To ensure you meet those requirements your lender will go through a process known as verification of employment VOE which is a part of the underwriting process. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

This is not an absolute rule though. The modern mortgage market began to take shape after the federal government intervened during the Great Depression. This is done to make sure nothing has changed with your employment status.

Web If your application depends on Commissioned Overtime or Bonus income for you to qualify then the lender will be required to average the last 24 months of history for that part of your income. An ideal scenario is when the borrower has at least two years of steady consecutive income. Web Here at Rocket Mortgage we usually verify your employment with your employer either over the phone or through a written request.

Web Add Employment History 1. Web With 6 months of work gaps you can get a mortgage but you have to provide as following also. Web Two Years the Standard Most lenders prefer lending to borrowers who have worked in the same field for at least two years believing they will more likely remain employed at their current companies or be able tp find a new job should they lose their current one.

Web Mortgages featured variable interest rates short maturities and high down payments by the early 1990s. Complete all Required Fields for the Employment History. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web Standard mortgage applications request a two-year work history. Before the Great Depression homeowners renegotiated their mortgages every year. This system wasnt perfect but it did provide homes.

Web Lenders want to know a lot about your work history when you In fact they will go back at least 24 months inquiring about where you worked as well as your income. Provided your last pay stubs covering 30 days of wages you need to work at least 6 months after your gap to be able to qualify for a conventional or FHA loan Can I Qualify for More House If My Income Incrased. Best Mortgage Lenders in New Jersey.

Search Property Homeowner Data On Millions Of Homes. Web Generally speaking mortgage lenders require that you have at least two years of employment history to qualify for a loan. If you have any gaps in your employment during that time you will have to explain them.

From the Employment History section of the Individual MU4 Form click the Add button. Your qualifications and training. But if youve been there for less than two years then your lender will consider the following.

Web As a rule of thumb mortgage lenders will typically verify your employment and income for the last two years. Web The exact flexibility youll have will depend on your mortgage loan program and the lender you choose. Web On a 5 year mortgage homebuyers would pay interest-only payments for the 5 year term.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. The first steps in getting a mortgage are to work out what kind of mortgage is best for you how much you can afford to pay and to obtain pre-approval for this loanIn.

Careers Best Life Mortgage

Buldana Urban Homepage

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Can I Buy A House Without A 2 Year Job History Podcast

7fyhup417e Fnm

Pipeline Magazine Summer 2019 By Acuma Issuu

A Main Street Perspective On The Wall Street Mortgage Crisis

20161208 Resume Algq

Lender Price And Blend Integrate To Enhance User Experience For Digital Lending Processes Send2press Newswire

Compliance Management Tool Flexible Vcomply

Mortgage With Short Employment History Lending Guidelines

Can I Get A Mortgage Without Two Years Work History Find Out How

One Quarter Of Td Mortgages Now Have An Amortization Of 35 Years Mortgage Rates Mortgage Broker News In Canada

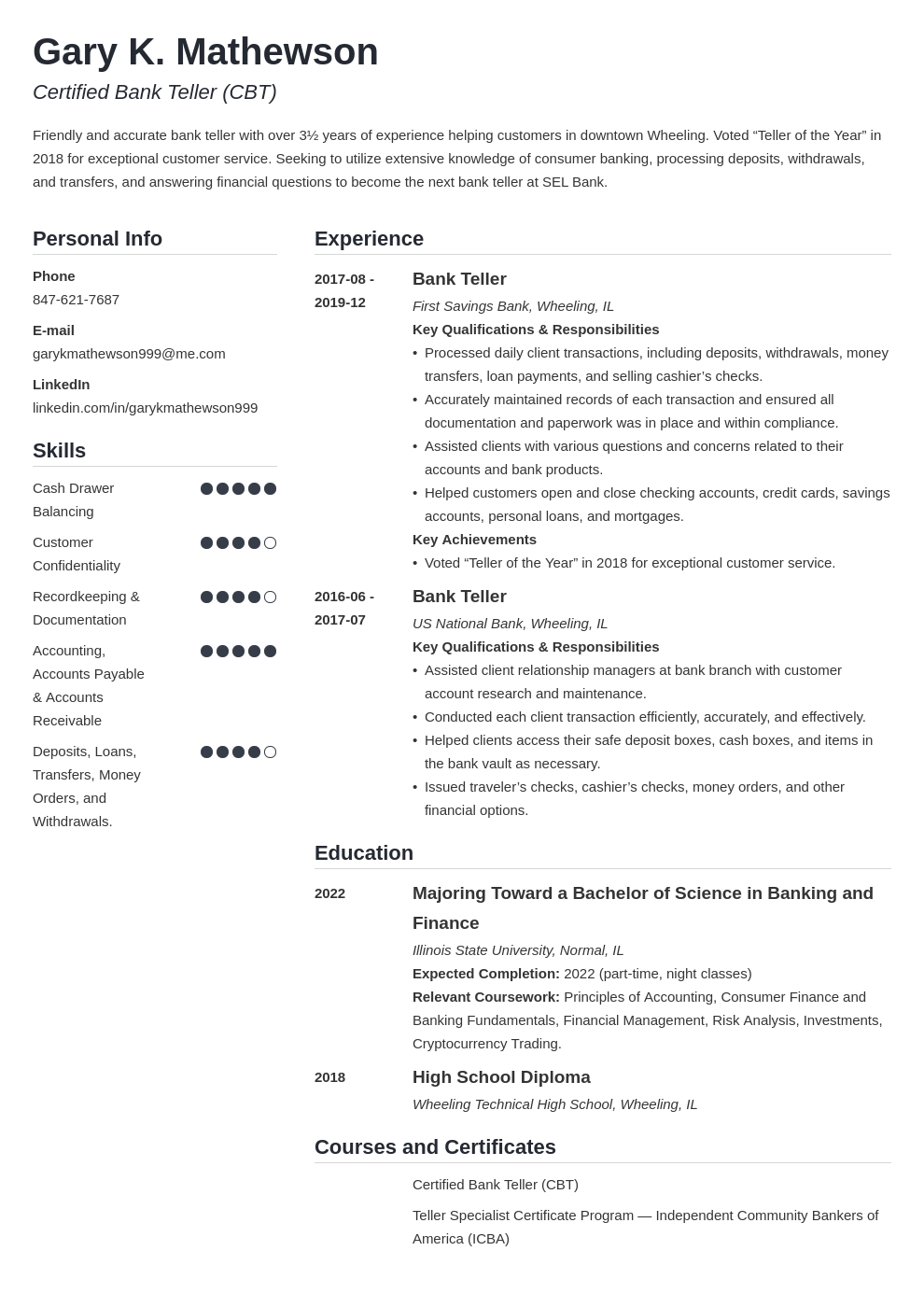

Bank Teller Resume Examples Bank Teller Skills

How Alpha Mortgage Saved 70 Per Loan File With Automation In Reggora

How Long Does A Mortgage Application Take Compare My Move

One Quarter Of Td Mortgages Now Have An Amortization Of 35 Years Mortgage Rates Mortgage Broker News In Canada